Multiple Choice

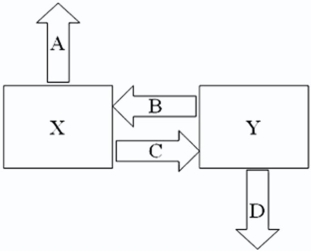

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for;

A = Company X's external borrowing rate

B = Company Y's payment to X (rate) C = Company X's payment to Y (rate) D = Company Y's external borrowing rate

A.A = 10%; B = 11.75%; C = LIBOR - .25%; D = LIBOR + 1.5%

B.A = 10%; B = 10%; C = LIBOR - .25%; D = LIBOR + 1.5%

C.A = LIBOR; B = 10%; C = LIBOR - .25%; D = 12%

D.A = LIBOR; B = LIBOR; C = LIBOR - .25%; D = 12%

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Correct Answer:

Verified

Q79: Compute the payments due in the

Q80: Consider the situation of firm A

Q81: XYZ Corporation enters into a 6-year interest

Q82: Which combination of the following represent the

Q83: Suppose that you are a swap

Q85: A major risk faced by a swap

Q86: Consider the situation of firm A

Q87: Suppose that the swap that you proposed

Q88: Consider the situation of firm A

Q89: Company X wants to borrow $10,000,000