Essay

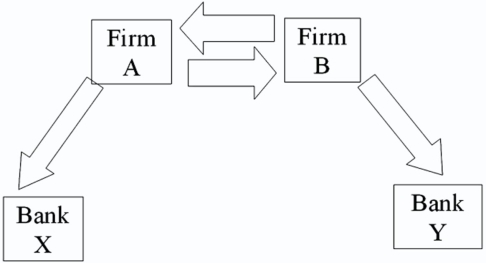

Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Devise a direct swap for A and B that has no swap bank.Show their external borrowing.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: When a swap bank serves as a

Q7: Consider the situation of firm A

Q8: Company X wants to borrow $10,000,000

Q9: Consider the situation of firm A

Q10: Consider the borrowing rates for Parties

Q12: A swap bank has identified two companies

Q13: A swap bank makes the following

Q14: Company X wants to borrow $10,000,000

Q15: Find the all-in-cost of a swap to

Q16: Consider the situation of firm A