Multiple Choice

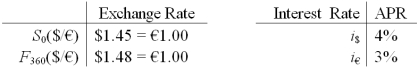

Suppose you observe the following 1-year interest rates,spot exchange rates and futures prices.Futures contracts are available on €10,000.How much risk-free arbitrage profit could you make on 1 contract at maturity from this mispricing?

A) $159.22

B) $153.10

C) $439.42

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Find the Black-Scholes price of a six-month

Q9: Using your results from parts a and

Q71: Comparing "forward" and "futures" exchange contracts, we

Q73: For European currency options written on euro

Q74: Exercise of a currency futures option results

Q80: The current spot exchange rate is $1.55

Q83: Draw the tree for a put option

Q88: Which of the following is correct?<br>A)The value

Q88: Which of the lines is a graph

Q91: For European currency options written on euro