Multiple Choice

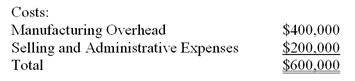

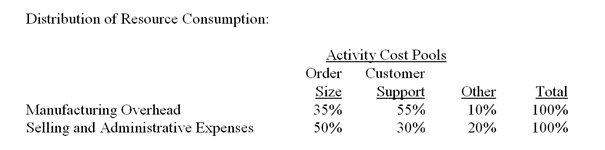

Davis Company uses an activity-based costing system in which there are three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of the costs to the activity cost pools.

-How much cost,in total should not be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision making?

A) $0.

B) $60,000.

C) $80,000.

D) $120,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Binegar Manufacturing Corporation has a traditional costing

Q36: Koszyk Manufacturing Corporation has a traditional costing

Q41: Grogam Catering uses activity-based costing for its

Q43: Ingersol Draperies makes custom draperies for homes

Q45: Addison Company has two products: A and

Q49: Abel Company uses activity-based costing.

Q61: Why may departmental overhead rates NOT correctly

Q71: When combining activities in an activity-based costing

Q110: Human resource management is an example of

Q122: Worker recreational facilities are examples of costs