Essay

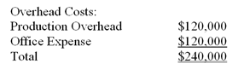

Ingersol Draperies makes custom draperies for homes and businesses.The company uses an activity-based costing system for its overhead costs.The company has provided the following data concerning its annual overhead costs and its activity cost pools:

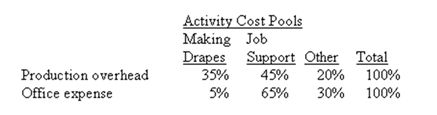

Distribution of Resource Consumption:

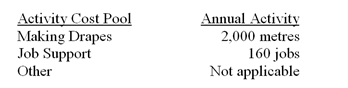

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

Required:

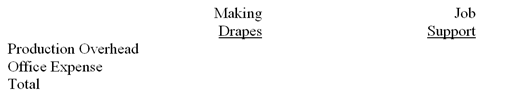

a) Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:

b) Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:

c) (Appendix 5A) Prepare an action analysis report in good form of a job that involves making 71 metres of drapes and has direct materials and direct labour cost of $2,510. The sales revenue from this job is $4,400. For purposes of this action analysis report, direct materials and direct labour should be classified as a Green cost, production overhead as a Red cost, and office expense as a Yellow cost.

Correct Answer:

Verified

a) First-stage alloc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Davis Company uses an activity-based costing system

Q41: Grogam Catering uses activity-based costing for its

Q45: Addison Company has two products: A and

Q47: Addison Company has two products: A and

Q48: Escalona Company is a wholesale distributor that

Q49: Abel Company uses activity-based costing.

Q61: Why may departmental overhead rates NOT correctly

Q71: When combining activities in an activity-based costing

Q71: Davis Company uses an activity-based

Q110: Human resource management is an example of