Essay

Flyer Corporation manufactures two products,Product A and Product A.Product B is produced on an automated production line.

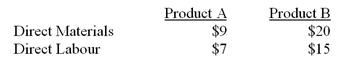

Overhead is currently assigned to the products on the basis of direct labour hours.The company estimated it would incur $396,000 in manufacturing overhead costs and produce 5,500 units of Product B and 22,000 units of Product A during the current year.Unit costs for materials and direct labour are:

Required:

a) Compute the predetermined overhead rate under the current method of allocation, and determine the unit product cost of each product for the current year.

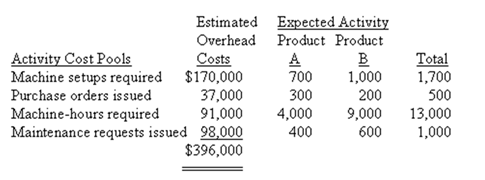

b) The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below:

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

Correct Answer:

Verified

a) The company expects to work 49,500 di...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: When there are batch-level or product-level costs,in

Q43: Dierich Company uses an activity-based

Q56: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1327/.jpg" alt=" -What would be

Q83: Mike Kyekyeku is a sole proprietorship that

Q87: (Appendix 5A)Which of the following best describes

Q88: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1327/.jpg" alt=" -What would be

Q89: Addy Company has two products: A and

Q90: Diehl Company uses an activity-based

Q90: Addison Company has two products: A and

Q94: Dierich Company uses an activity-based