Essay

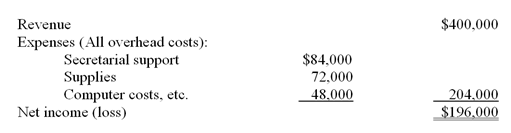

Mike Kyekyeku is a sole proprietorship that provides consulting and tax preparation services to its clients.Mike charges a fee of $100 per hour for each service and can devote a maximum of 4,000 hours annually to his clients.He reported the following revenues and expenses for 2008:

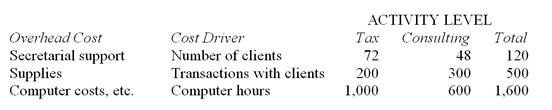

Being an accountant, Mike kept good records of the following data for 2008:

(i).

(ii).

Required:

a. Should Mike emphasize one service more than the other if Mike were to allocate all the overhead costs using direct-labours as the only overhead cost driver (1,300 for Tax and 2,700 for Consulting)? Support your decision with the relevant calculations and/or analysis.

b. Identify each of the three cost drivers as either unit-level, batch-level, product-level, customer-level, or organization-sustaining.

c. How might Mike's product/service emphasis decision in Part a above be altered if he were to allocate all the overhead costs using activity-based costing and the three cost drivers, that is, number of clients, number of transactions with clients, and computer hours? Show all your supporting calculations and/or analysis, including any necessary explanation.

Correct Answer:

Verified

a.

Decision: No

Analysis and/or calcula...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Decision: No

Analysis and/or calcula...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: When there are batch-level or product-level costs,in

Q43: Dierich Company uses an activity-based

Q56: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1327/.jpg" alt=" -What would be

Q62: Acton Company has two products: A and

Q74: Acton Company has two products: A and

Q78: Dierich Company uses an activity-based costing system

Q86: Flyer Corporation manufactures two products,Product A and

Q87: (Appendix 5A)Which of the following best describes

Q90: Diehl Company uses an activity-based

Q94: Dierich Company uses an activity-based