Multiple Choice

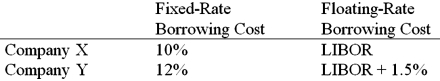

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. What is the value of this swap to company X?

A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. What is the value of this swap to company X?

A) Company X will lose money on the deal.

B) Company X will save 25 basis points per year on $10,000,000 = $25,000 per year.

C) Company X will only break even on the deal.

D) Company X will save 5 basis points per year on $10,000,000 = $5,000 per year.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Use the following information to calculate the

Q28: Show how your proposed swap would work

Q30: A major risk faced by a swap

Q31: Consider the dollar- and euro-based borrowing opportunities

Q33: Amortizing currency swaps<br>A)the debt service exchanges decrease

Q34: Suppose that you are a swap bank

Q35: Some of the risks that a swap

Q36: When a swap bank serves as a

Q37: Suppose the quote for a five-year swap

Q84: Explain how firm B could use the