Multiple Choice

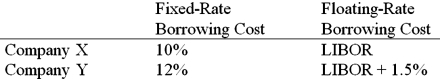

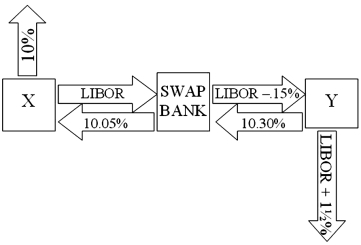

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 10.05%. Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.

A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 10.05%. Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

A) The swap bank will earn 40 basis points per year on $10,000,000 = $40,000 per year.

B) The swap bank will earn 10 basis points per year on $10,000,000 = $10,000 per year.

C) The swap bank will LOSE money.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q75: Explain how firm A could use the

Q90: Explain how this opportunity affects which swap

Q92: Consider the dollar- and euro-based borrowing opportunities

Q93: Compute the payments due in the FIRST

Q94: XYZ Corporation enters into a 6-year interest

Q95: An interest-only single currency interest rate swap<br>A)is

Q97: Consider a fixed for fixed currency swap.

Q98: In the problem just previous, company X<br>A)is

Q99: Consider bank that has entered into a

Q100: A swap bank makes the following quotes