Multiple Choice

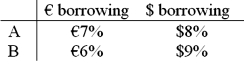

Consider the dollar- and euro-based borrowing opportunities of companies A and

A) Yes, QSD = [€7% - €6% × $2.00/€1.00 - ($8% - $9%) = $2% + $1% = $3%

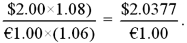

B)  A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = €1.00 and the one-year forward rate is given by IRP as:

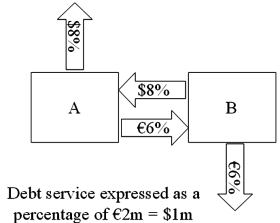

A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = €1.00 and the one-year forward rate is given by IRP as:  Suppose they agree to the swap shown at right. Is this mutually beneficial swap equally fair to both parties?

Suppose they agree to the swap shown at right. Is this mutually beneficial swap equally fair to both parties?

B) No, company A borrows at 6% in euro but company B borrows at 8% in dollars

C) Yes, A will be better off by €1% on €1m; B by 1% on $2m and $2.00 = €1.00

D) No, company A saves 1% in euro but company B saves only 1% in dollars when the spot exchange rate is $2.00 = €1.00-A is twice as better off as B

Correct Answer:

Verified

Correct Answer:

Verified

Q2: What would be the interest rate?

Q75: Explain how firm A could use the

Q87: Consider a plain vanilla interest rate swap.

Q88: Suppose that the swap that you proposed

Q90: Explain how this opportunity affects which swap

Q93: Compute the payments due in the FIRST

Q94: XYZ Corporation enters into a 6-year interest

Q95: An interest-only single currency interest rate swap<br>A)is

Q96: Company X wants to borrow $10,000,000 floating

Q97: Consider a fixed for fixed currency swap.