Essay

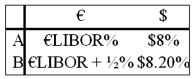

Come up with a swap (principal + interest) for two parties A and B who have the following borrowing opportunities.  The current exchange rate is $1.60 = €1.00. Company "A" wishes to borrow $1,000,000 for 5 years and "B" wants to borrow €625,000 for 5 years. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B. Firms A and B are more concerned with what currency that they borrow in than whether the debt is fixed or floating.

The current exchange rate is $1.60 = €1.00. Company "A" wishes to borrow $1,000,000 for 5 years and "B" wants to borrow €625,000 for 5 years. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B. Firms A and B are more concerned with what currency that they borrow in than whether the debt is fixed or floating.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Consider fixed-for-fixed currency swap. Firm A is

Q12: A swap bank has identified two companies

Q13: Company X wants to borrow $10,000,000 floating

Q14: When a swap bank serves as a

Q15: Suppose that the swap that you proposed

Q18: A major that can be eliminated through

Q20: With regard to a swap bank acting

Q21: The primary reasons for a counterparty to

Q28: Show how your proposed swap would work

Q60: Explain how this opportunity affects which swap