Multiple Choice

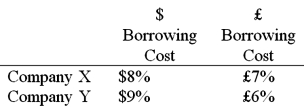

Company X wants to borrow $10,000,000 floating for 1 year; company Y wants to borrow £5,000,000 fixed for 1 year. The spot exchange rate is $2 = £1 and IRP calculates the one-year forward rate as $2.00 × (1.08) /£1.00 × (1.06) = $2.0377/£1. Their external borrowing opportunities are:  A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

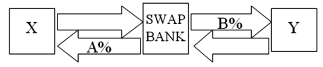

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

A) A = £7%; B = $9%.

B) A = $8%; B = £6%.

C) A = $7%; B = £7%.

D) A = $8%; B = £8%.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Consider the situation of firm A and

Q9: Explain how firm B could use the

Q10: A swap bank<br>A)can act as a broker,

Q11: Consider fixed-for-fixed currency swap. Firm A is

Q12: A swap bank has identified two companies

Q14: When a swap bank serves as a

Q15: Suppose that the swap that you proposed

Q16: Come up with a swap (principal +

Q18: A major that can be eliminated through

Q28: Show how your proposed swap would work