Multiple Choice

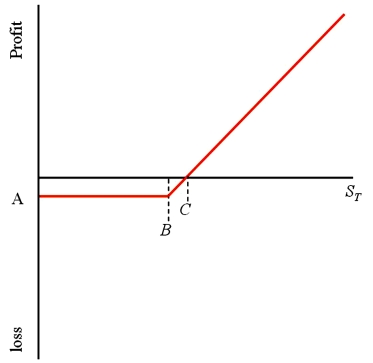

Consider the graph of a call option shown at right. The option is a three-month American call option on €62,500 with a strike price of $1.50 = €1.00 and an option premium of $3,125. What are the values of A, B, and C, respectively?

A) A = -$3,125 (or -$.05 depending on your scale) ; B = $1.50; C = $1.55

B) A = -€3,750 (or -€.06 depending on your scale) ; B = $1.50; C = $1.55

C) A = -$.05; B = $1.55; C = $1.60

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The "open interest" shown in currency futures

Q46: Find the dollar value today of a

Q59: Find the hedge ratio for a put

Q61: Find the value of a call option

Q63: Use the European option pricing formula to

Q65: In reference to the futures market, a

Q66: Find the input d<sub>1</sub> of the Black-Scholes

Q67: USING RISK NEUTRAL VALUATION find the value

Q68: Which equation is used to define the

Q69: The Black-Scholes option pricing formulae<br>A)are used widely