Multiple Choice

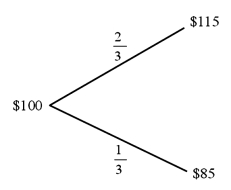

Find the value of a call option written on €100 with a strike price of $1.00 = €1.00. In one period there are two possibilities: the exchange rate will move up by 15% or down by 15% . The U.S. risk-free rate is 5% over the period. The risk-neutral probability of dollar depreciation is 2/3 and the risk-neutral probability of the dollar strengthening is 1/3.

A) $9.5238

B) $0.0952

C) $0

D) $3.1746

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The "open interest" shown in currency futures

Q46: Find the dollar value today of a

Q57: For European options, what of the effect

Q58: Find the hedge ratio for a put

Q59: Find the hedge ratio for a put

Q63: Use the European option pricing formula to

Q64: Consider the graph of a call option

Q65: In reference to the futures market, a

Q66: Find the input d<sub>1</sub> of the Black-Scholes

Q69: If a currency futures contract (direct quote)is