Multiple Choice

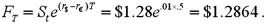

Assume that the dollar-euro spot rate is $1.28 and the six-month forward rate is  The six-month U.S. dollar rate is 5% and the Eurodollar rate is 4%. The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

The six-month U.S. dollar rate is 5% and the Eurodollar rate is 4%. The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

A) 0 cents.

B) 3.47 cents.

C) 3.55 cents.

D) 3 cents.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Find the Black-Scholes price of a six-month

Q2: For European currency options written on euro

Q3: In which market does a clearinghouse serve

Q4: In the event of a default on

Q8: Suppose you observe the following 1-year interest

Q9: Using your results from parts a and

Q10: Comparing "forward" and "futures" exchange contracts, we

Q11: Find the cost today of your hedge

Q85: A European option is different from an

Q93: State the composition of the replicating portfolio;