Multiple Choice

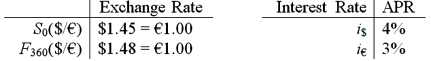

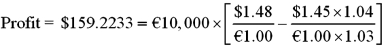

Suppose you observe the following 1-year interest rates, spot exchange rates and futures prices. Futures contracts are available on €10,000. How much risk-free arbitrage profit could you make on 1 contract at maturity from this mispricing?

A) $159.22

B) $153.10

C) $439.42

D) None of the above The futures price of $1.48/€ is above the IRP futures price of $1.4641/€, so we want to sell .  To hedge, we borrow $14,077.67 today at 4%, convert to euro at the spot rate of $1.45/€, invest at 3%. At maturity, our investment matures and pays €10,000, which we sell for $14,800, and then we repay our dollar borrowing with $14,640.78. Our risk-free profit = $159.22 = $14,800 - $14,640.78.

To hedge, we borrow $14,077.67 today at 4%, convert to euro at the spot rate of $1.45/€, invest at 3%. At maturity, our investment matures and pays €10,000, which we sell for $14,800, and then we repay our dollar borrowing with $14,640.78. Our risk-free profit = $159.22 = $14,800 - $14,640.78.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: In which market does a clearinghouse serve

Q4: In the event of a default on

Q5: Assume that the dollar-euro spot rate is

Q9: Using your results from parts a and

Q10: Comparing "forward" and "futures" exchange contracts, we

Q11: Find the cost today of your hedge

Q13: Draw the tree for a put option

Q33: Suppose the futures price is below the

Q85: A European option is different from an

Q93: State the composition of the replicating portfolio;