Multiple Choice

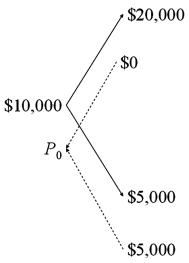

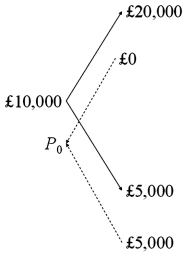

Draw the tree for a put option on $20,000 with a strike price of £10,000. The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half. The current interest rates are i$ = 3% and are i£ = 2%.

A)

B)

C) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Suppose you observe the following 1-year interest

Q9: Using your results from parts a and

Q10: Comparing "forward" and "futures" exchange contracts, we

Q11: Find the cost today of your hedge

Q14: Calculate the current €/£ spot exchange rate.

Q15: Find the risk-neutral probability of an "up"

Q16: If the call finishes out-of-the-money what is

Q16: Most exchange traded currency options<br>A)mature every month,with

Q17: Yesterday, you entered into a futures contract

Q33: Suppose the futures price is below the