Multiple Choice

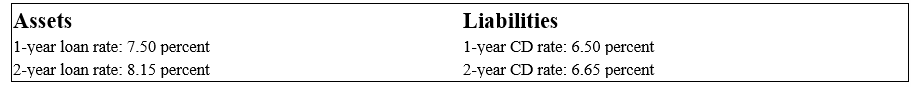

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.

-If rates do not change,the balance sheet position that maximizes the FI's returns is

A) a positive spread of 15 basis points by selling 1-year CDs to finance 2-year CDs.

B) a positive spread of 100 basis points by selling 1-year CDs to finance 1-year loans.

C) a positive spread of 85 basis points by financing the purchase of a 1-year loan with a 2-year CD.

D) a positive spread of 165 basis points by selling 1-year CDs to finance 2-year loans.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Investing in a zero-coupon asset with a

Q42: The use of duration to predict changes

Q95: For a given change in required yields,

Q96: Suppose a pension fund must have $10,000,000

Q97: What is the price of the bond

Q102: What is the percentage price change for

Q103: Market value accounting reflects economic reality of

Q104: The following is an FI's balance sheet

Q107: The leverage adjusted duration of a typical

Q114: Attempts to satisfy the objectives of shareholders