Multiple Choice

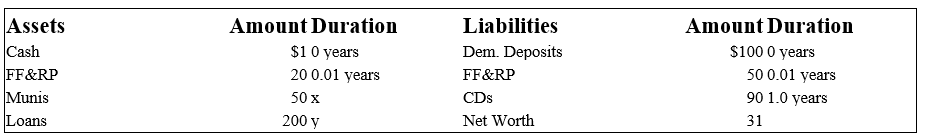

The following is an FI's balance sheet ($millions) .

Notes to Balance Sheet.

Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. CDs are 1-year pure discount certificates of deposit paying 4.75 percent.

-What is this bank's interest rate risk exposure,if any?

A) The bank is exposed to decreasing interest rates because it has a negative duration gap of -0.21 years.

B) The bank is exposed to increasing interest rates because it has a negative duration gap of -0.21 years.

C) The bank is exposed to increasing interest rates because it has a positive duration gap of +0.21 years.

D) The bank is exposed to decreasing interest rates because it has a positive duration gap of +0.21 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Perfect matching of the maturities of the

Q24: Investing in a zero-coupon asset with a

Q42: The use of duration to predict changes

Q95: For a given change in required yields,

Q100: The following information is about current spot

Q102: What is the percentage price change for

Q103: Market value accounting reflects economic reality of

Q107: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1314/.jpg" alt=" -Calculate the duration

Q109: The following information is about current spot

Q122: The error from using duration to estimate