Multiple Choice

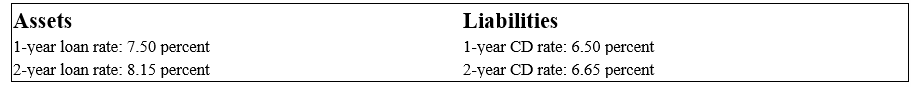

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.

-If the FI finances a $500,000 2-year loan with a $400,000 1-year CD and equity,what is the leveraged adjusted duration gap of this position? Use your answer to the previous question.

A) +1.25 years

B) +1.12 years

C) -1.12 years

D) +0.92 years

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Immunization of an FIs net worth requires

Q5: The duration of a consol bond is<br>A)less

Q7: Immunizing the balance sheet to protect equity

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1314/.jpg" alt=" -Calculate the leverage-adjusted

Q10: The duration of all floating rate debt

Q12: An FI can immunize its portfolio by

Q26: The economic meaning of duration is the

Q29: In duration analysis, the times at which

Q48: Deep discount bonds are semi-annual fixed-rate coupon

Q125: Normally, duration is less than the maturity