Multiple Choice

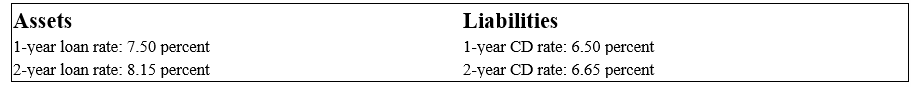

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.

-Use the duration model to approximate the change in the market value (per $100 face value) of two-year loans if interest rates increase by 100 basis points.

A) -$1.756

B) -$1.775

C) +$98.24

D) -$1.000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The difference between the changes in the

Q35: The shortcomings of this strategy are the

Q36: The numbers provided are in millions of

Q37: The following information is about current spot

Q39: Third Duration Investments has the following assets

Q41: The numbers provided by Fourth Bank of

Q42: U.S. Treasury quotes from the WSJ on

Q45: What is the FI's interest rate risk

Q87: Immunizing the net worth ratio requires that

Q119: Immunizing net worth from interest rate risk