Multiple Choice

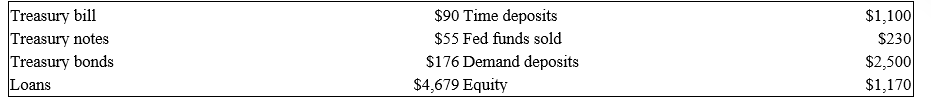

The numbers provided by Fourth Bank of Duration are in thousands of dollars.

Notes: All Treasury bills have six months until maturity.One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually.Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years.Time deposits have a 1-year duration and the Fed funds duration is 0.003 years.Fourth Bank of Duration assigns a duration of zero (0) to demand deposits.

-What is the bank's leverage adjusted duration gap?

A) 6.73 years

B) 0.29 years

C) 6.44 years

D) 6.51 years

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The difference between the changes in the

Q36: The numbers provided are in millions of

Q37: The following information is about current spot

Q39: Third Duration Investments has the following assets

Q40: The following information is about current spot

Q42: U.S. Treasury quotes from the WSJ on

Q45: What is the FI's interest rate risk

Q46: The following is an FI's balance sheet

Q87: Immunizing the net worth ratio requires that

Q119: Immunizing net worth from interest rate risk