Multiple Choice

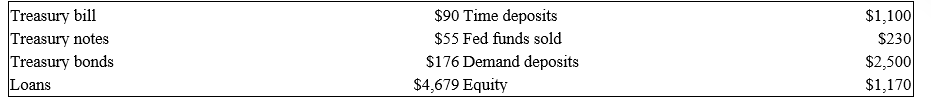

The numbers provided by Fourth Bank of Duration are in thousands of dollars.

Notes: All Treasury bills have six months until maturity.One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually.Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years.Time deposits have a 1-year duration and the Fed funds duration is 0.003 years.Fourth Bank of Duration assigns a duration of zero (0) to demand deposits.

-If the relative change in interest rates is a decrease of 1 percent,calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1 + R) = -1 percent)

A) The bank's market value of equity increases by $325,550.

B) The bank's market value of equity decreases by $325,550.

C) The bank's market value of equity increases by $336,500.

D) The bank's market value of equity decreases by $336,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Perfect matching of the maturities of the

Q42: The use of duration to predict changes

Q91: The larger the interest rate shock, the

Q107: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1314/.jpg" alt=" -Calculate the duration

Q109: The following information is about current spot

Q112: When does "duration" become a less accurate

Q114: The following is an FI's balance sheet

Q115: Consider a one-year maturity,$100,000 face value bond

Q122: The error from using duration to estimate

Q126: For given changes in interest rates, the