Multiple Choice

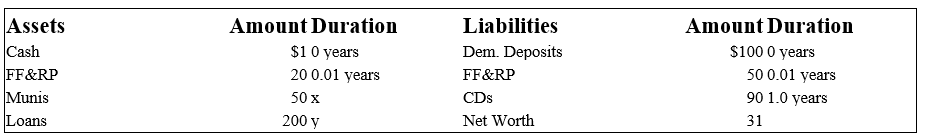

The following is an FI's balance sheet ($millions) .

Notes to Balance Sheet.

Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. CDs are 1-year pure discount certificates of deposit paying 4.75 percent.

-What will be the impact,if any,on the market value of the bank's equity if all interest rates increase by 75 basis points?

A) The market value of equity will decrease by $15,750.

B) The market value of equity will increase by $15,750.

C) The market value of equity will decrease by $426,825.

D) The market value of equity will increase by $426,825.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: The fact that the capital gain effect

Q52: Duration is the weighted-average present value of

Q89: The rate of change in duration values

Q91: The larger the interest rate shock, the

Q109: The following information is about current spot

Q110: The numbers provided by Fourth Bank

Q112: When does "duration" become a less accurate

Q115: Consider a one-year maturity,$100,000 face value bond

Q116: Calculate the duration of a two-year corporate

Q126: For given changes in interest rates, the