Multiple Choice

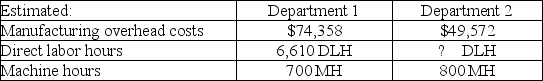

A company allocates $7.50 overhead to products based on the number of direct labor hours worked. The company uses a plantwide overhead rate with direct labor hours as the allocation base. Given the amounts below, how many direct labor hours does the company expect in department 2?

A) 9,914 DLH

B) 6,612 DLH

C) 3,109 DLH

D) 7,454 DLH

E) 16,254 DLH

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Batch-level costs do not vary with the

Q137: Because departmental overhead costs are allocated based

Q150: A single cost pool is used when

Q194: Blast Rocket Company manufactures candy-coated popcorn treats

Q195: Slosh, Inc. produces washing machines that require

Q196: Red Raider Company uses a plantwide overhead

Q198: Turtle Company produces t-shirts that go through

Q200: A company uses activity-based costing to determine

Q202: A company uses activity-based costing to determine

Q204: The following data relates to Patterson Company's