Essay

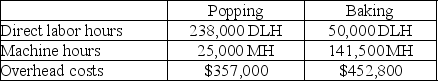

Blast Rocket Company manufactures candy-coated popcorn treats that go through two operations, popping and baking, before they are complete. Expected costs and activities for the two departments are shown in the following table

:

a. Compute a departmental overhead rate for the popping department based on direct labor hours.

a. Compute a departmental overhead rate for the popping department based on direct labor hours.

b. Compute a departmental overhead rate for the baking department based on machine hours.

Correct Answer:

Verified

a. $357,000/238,000 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: What are the major advantages of using

Q150: A single cost pool is used when

Q167: Activities are the cost objects of the

Q192: A company identified the following partial list

Q193: ABC systems _.<br>A) usually will undercost complicated

Q195: Slosh, Inc. produces washing machines that require

Q196: Red Raider Company uses a plantwide overhead

Q198: Turtle Company produces t-shirts that go through

Q199: A company allocates $7.50 overhead to products

Q217: When products differ in batch size and