Essay

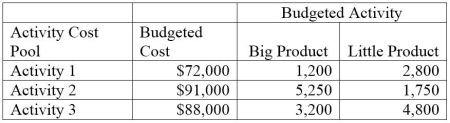

A company has two products: Big and Little. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:  Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

a. Compute the approximate overhead cost per unit of big product under activity-based costing.

b. Compute the approximate overhead cost per unit of little product under activity-based costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The _ overhead rate method uses a

Q14: By definition,costs classified as overhead are consumed

Q39: ABC can be used to assign costs

Q90: Assume that the Assembly Department allocates overhead

Q112: Management's pricing and cost decisions for a

Q148: Which of the following statements is true

Q176: The use of departmental overhead rates will

Q177: Superior Products Manufacturing identified the following data

Q183: K Company estimates that overhead costs for

Q209: What are three advantages of activity-based costing