Multiple Choice

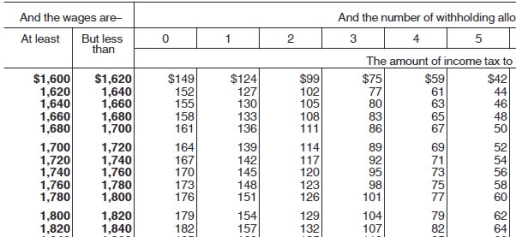

Trish earned $1,734.90 during the most recent semimonthly pay period.She is married and has 3 withholding allowances.Based on the following table,how much should be withheld from her gross pay for Federal income tax?

A) $92.00

B) $89.00

C) $95.00

D) $69.00

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Garnishments are court-ordered amounts that an employer

Q25: Which Act extended health care benefits to

Q26: Caroljane earned $1,120 during the most recent

Q28: The factors that determine an employee's Federal

Q29: Ross is a full-time employee who earns

Q31: Jeannie is an adjunct faculty at a

Q32: Maile is a full-time exempt employee who

Q34: Janna is a salaried nonexempt employee who

Q35: Wyatt is a full-time exempt music engineer

Q35: Which of the following may be included