Multiple Choice

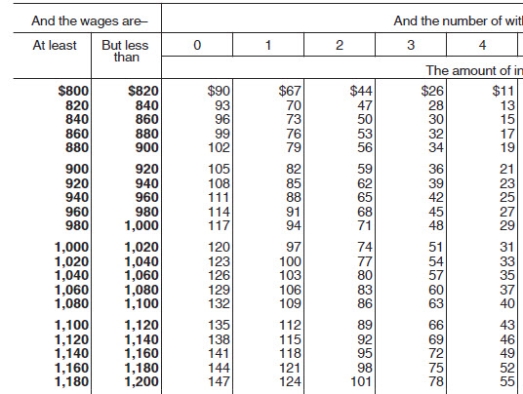

Caroljane earned $1,120 during the most recent pay biweekly pay period.She contributes 4% of her gross pay to her 401(k) plan.She is single and has 1 withholding allowance.Based on the following table,how much Federal income tax should be withheld from her pay?

A) $115.00

B) $106.00

C) $112.00

D) $109.00

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Garnishments are court-ordered amounts that an employer

Q21: What is a disadvantage to using paycards

Q21: Paolo is a part-time security guard for

Q22: Amity is an employee with a period

Q24: Ramani earned $1,698.50 during the most recent

Q25: Which Act extended health care benefits to

Q28: The factors that determine an employee's Federal

Q29: Ross is a full-time employee who earns

Q30: Trish earned $1,734.90 during the most recent

Q31: Jeannie is an adjunct faculty at a