Multiple Choice

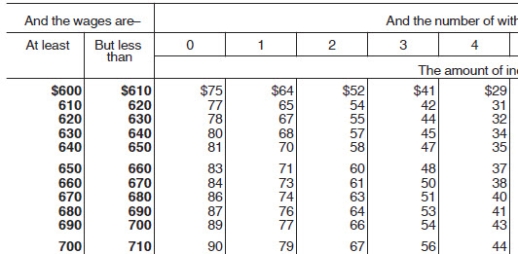

Andie earned $680.20 during the most recent weekly pay period.She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan.If she chooses the method that results in the lowest taxable income,how much will be withheld for Federal income tax (based on the following table) ?

A) $58.00

B) $60.00

C) $48.00

D) $47.00

Correct Answer:

Verified

Correct Answer:

Verified

Q1: According to the Consumer Credit Protection Act,what

Q6: The use of paycards as a means

Q40: Which of the following best describes a

Q54: The purpose of the wage base used

Q56: Vivienne is a full-time exempt employee in

Q57: Brent is a full-time exempt employee in

Q58: What role does the employer play regarding

Q61: Manju is a full-time exempt employee living

Q63: Julian is a part-time employee who earns

Q64: Which is not a best practice for