Multiple Choice

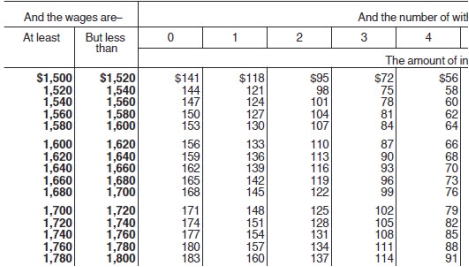

Manju is a full-time exempt employee living in Illinois who earns $43,680 annually and is paid biweekly.She is married with three withholding allowances.What is the total of her Federal and state income tax deductions for the most recent pay period? (Use the wage bracket tables.Illinois state income tax rate is 3.75%.Round final answer to two decimal points.)

A) $162

B) $122

C) $156

D) $166

Correct Answer:

Verified

Correct Answer:

Verified

Q1: According to the Consumer Credit Protection Act,what

Q6: The use of paycards as a means

Q56: Vivienne is a full-time exempt employee in

Q57: Brent is a full-time exempt employee in

Q58: What role does the employer play regarding

Q59: Andie earned $680.20 during the most recent

Q63: Julian is a part-time employee who earns

Q64: Which is not a best practice for

Q65: The wage-bracket of determining Federal tax withholding

Q66: Olga earned $1,558.00 during the most