Multiple Choice

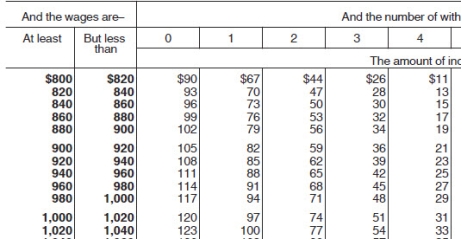

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period.She is single with 1 withholding allowance and both lives and works in Maryland.Assuming that she had no overtime,what is the total of her Federal and state taxes for a pay period? (Use the wage-bracket tables.Maryland state income rate is 4.75%.Round final answers to 2 decimal places.)

A) $144.25

B) $141.03

C) $145.95

D) $140.78

Correct Answer:

Verified

Correct Answer:

Verified

Q1: According to the Consumer Credit Protection Act,what

Q6: The use of paycards as a means

Q31: Natalia is a full-time exempt employee who

Q61: Manju is a full-time exempt employee living

Q63: Julian is a part-time employee who earns

Q64: Which is not a best practice for

Q65: The wage-bracket of determining Federal tax withholding

Q66: Olga earned $1,558.00 during the most

Q67: State and Local Income Tax rates _.<br>A)

Q70: Post-Tax Deductions are amounts _.<br>A) That are