Multiple Choice

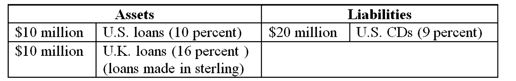

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-If the exchange rate had fallen from $1.60/≤1 at the beginning of the year to $1.50/≤1 at the end of the year, the net interest margin for the FI on its balance sheet investments is

A) 3.2875%.

B) -3.2875%.

C) 4%.

D) 8.75%.

E) 0.375%.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Forward contracts in FX are typically written

Q3: How would you characterize the FI's risk

Q6: Your U.S. bank issues a one-year U.S.

Q9: How would you characterize the FI's risk

Q10: The one-year CD rates for financial institutions

Q11: What is the end-of-year profit or loss

Q12: Directly matching foreign asset and liability books

Q45: The FI is acting as a speculator

Q70: According to purchasing power parity (PPP), foreign

Q75: Most profits or losses on foreign trading