Multiple Choice

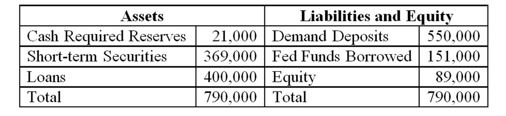

-What are the possible ways that the bank can meet an expected net deposit drain of +4 percent using purchased liquidity management techniques?

A) Utilize further the Fed funds market.

B) Utilize repurchase agreements.

C) Liquidate all cash holdings.

D) All of the above.

E) Answers A and B only.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Government securities represent the reserve asset fund

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2401/.jpg" alt=" The average interest

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2401/.jpg" alt=" The average interest

Q28: Hedge funds are not susceptible to liquidity

Q30: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2401/.jpg" alt=" The average interest

Q31: The price at which an open-end investment

Q32: A bank's net deposit drain<br>A)is negative if

Q34: Abnormally large and unexpected deposit withdrawals can

Q54: A disadvantage of using stored liquidity management

Q93: If the bank decides to cut down