Multiple Choice

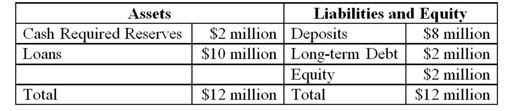

The average interest earned on the loans is 6 percent and the average cost of deposits is 5 percent. Rising interest rates are expected to reduce the deposits by $3 million. Borrowing more debt will cost the bank 5.5 percent in the short term.

The average interest earned on the loans is 6 percent and the average cost of deposits is 5 percent. Rising interest rates are expected to reduce the deposits by $3 million. Borrowing more debt will cost the bank 5.5 percent in the short term.

-What will be the size of the bank if a stored liquidity management strategy is adopted?

A) $9 million.

B) $11 million.

C) $12 million.

D) $14 million.

E) $15 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Government securities represent the reserve asset fund

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2401/.jpg" alt=" The average interest

Q26: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2401/.jpg" alt=" -What are the

Q28: Hedge funds are not susceptible to liquidity

Q30: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2401/.jpg" alt=" The average interest

Q31: The price at which an open-end investment

Q32: A bank's net deposit drain<br>A)is negative if

Q32: Open-end mutual funds issue a fixed number

Q54: A disadvantage of using stored liquidity management

Q93: If the bank decides to cut down