Multiple Choice

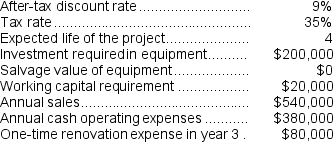

Barbera Corporation has provided the following information concerning a capital budgeting project: The company uses straight-line depreciation on all equipment.

The company uses straight-line depreciation on all equipment.

The total cash flow net of income taxes in year 3 is:

A) $41,500

B) $121,500

C) $69,500

D) $80,000

Correct Answer:

Verified

Correct Answer:

Verified

Q30: (Appendix 13C) Stockinger Corporation has provided

Q31: (Appendix 13C) Houze Corporation has provided the

Q32: (Appendix 13C) Bedolla Corporation is considering a

Q33: Halwick Corporation is considering a capital budgeting

Q34: Shilt Corporation is considering a capital budgeting

Q36: (Appendix 13C) Boynes Corporation is considering a

Q37: (Appendix 13C) Donayre Corporation is considering a

Q38: Last year the sales at Summit Corporation

Q39: (Appendix 13C) Waltermire Corporation has provided the

Q40: Vore Corporation is considering a capital budgeting