Essay

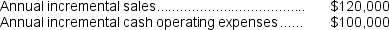

Shilt Corporation is considering a capital budgeting project that would require investing $40,000 in equipment with a 4 year useful life and zero salvage value.Data concerning that project appear below:

The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The company's tax rate is 35% and the after-tax discount rate is 13%.

The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The company's tax rate is 35% and the after-tax discount rate is 13%.

Required:

Determine the net present value of the project.Show your work!

Correct Answer:

Verified

Depreciation expense = (Origin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Bellows Corporation is considering a capital budgeting

Q30: (Appendix 13C) Stockinger Corporation has provided

Q31: (Appendix 13C) Houze Corporation has provided the

Q32: (Appendix 13C) Bedolla Corporation is considering a

Q33: Halwick Corporation is considering a capital budgeting

Q35: Barbera Corporation has provided the following information

Q36: (Appendix 13C) Boynes Corporation is considering a

Q37: (Appendix 13C) Donayre Corporation is considering a

Q38: Last year the sales at Summit Corporation

Q39: (Appendix 13C) Waltermire Corporation has provided the