Multiple Choice

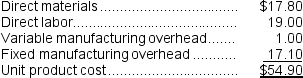

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

-What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 70,000 units required each year?

A) $50.60 per unit

B) $3.90 per unit

C) $58.80 per unit

D) $54.90 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q159: The Tolar Corporation has 400 obsolete desk

Q160: The SP Corporation makes 40,000 motors to

Q161: Bertucci Corporation makes three products that use

Q162: The Draper Corporation is considering dropping its

Q164: Mcniff Corporation makes a range of products.The

Q165: Mcfarlain Corporation is presently making part U98

Q166: Bowen Company produces products P,Q,and R from

Q167: Younes Inc. manufactures industrial components. One of

Q181: Sunk costs are never relevant in decision

Q282: A disadvantage of vertical integration is that