Multiple Choice

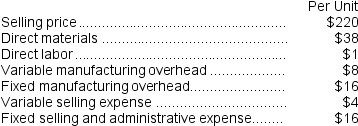

Younes Inc. manufactures industrial components. One of its products, which is used in the construction of industrial air conditioners, is known as P06. Data concerning this product are given below:

The above per unit data are based on annual production of 4,000 units of the component. Assume that direct labor is a variable cost.

The above per unit data are based on annual production of 4,000 units of the component. Assume that direct labor is a variable cost.

-The company has received a special,one-time-only order for 500 units of component P06.There would be no variable selling expense on this special order and the total fixed manufacturing overhead and fixed selling and administrative expenses of the company would not be affected by the order.However,assume that Younes has no excess capacity and this special order would require 30 minutes of the constraining resource,which could be used instead to produce products with a total contribution margin of $10,000.What is the minimum price per unit below which the company should not accept the special order?

A) $67 per unit

B) $103 per unit

C) $20 per unit

D) $83 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Kinsi Corporation manufactures five different products. All

Q162: The Draper Corporation is considering dropping its

Q163: Ahrends Corporation makes 70,000 units per year

Q164: Mcniff Corporation makes a range of products.The

Q165: Mcfarlain Corporation is presently making part U98

Q166: Bowen Company produces products P,Q,and R from

Q169: Mae Refiners, Inc., processes sugar cane that

Q172: Elly Industries is a multi-product company that

Q181: Sunk costs are never relevant in decision

Q382: One way to increase the effective utilization