Multiple Choice

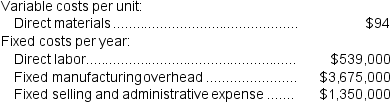

(Appendix 6A) Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

-Assume that the company uses an absorption costing system that assigns $11 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced.The unit product cost under this costing system is:

A) $94 per unit

B) $180 per unit

C) $105 per unit

D) $210 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q4: (Appendix 6A) Letcher Corporation manufactures and sells

Q5: (Appendix 6A) Buckbee Corporation manufactures and sells

Q6: Sawicki Corporation manufactures and sells one product.The

Q7: (Appendix 6A) Union Corporation manufactures and sells

Q8: (Appendix 6A) Marcelin Corporation manufactures and sells

Q10: (Appendix 6A) Leheny Corporation manufactures and sells

Q12: (Appendix 6A) Buckbee Corporation manufactures and sells

Q13: (Appendix 6A) Dallavalle Corporation manufactures and sells

Q14: (Appendix 6A) Marcelin Corporation manufactures and sells

Q229: All differences between super-variable costing and variable