Essay

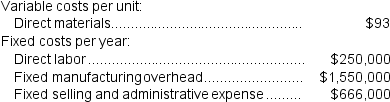

Sawicki Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses.During its first year of operations,the company produced 25,000 units and sold 18,000 units.The company's only product is sold for $224 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses.During its first year of operations,the company produced 25,000 units and sold 18,000 units.The company's only product is sold for $224 per unit.

Required:

a.Assume the company uses super-variable costing.Compute the unit product cost for the year and prepare an income statement for the year.

b.Assume that the company uses an absorption costing system that assigns $10 of direct labor cost and $62 of fixed manufacturing overhead to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

Correct Answer:

Verified

a.Under super-variable costing...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Paparelli Corporation manufactures and sells one product.The

Q2: (Appendix 6A) Tremble Corporation manufactures and sells

Q3: Dattilio Corporation manufactures and sells one product.The

Q4: (Appendix 6A) Letcher Corporation manufactures and sells

Q5: (Appendix 6A) Buckbee Corporation manufactures and sells

Q7: (Appendix 6A) Union Corporation manufactures and sells

Q8: (Appendix 6A) Marcelin Corporation manufactures and sells

Q9: (Appendix 6A) Tremble Corporation manufactures and sells

Q10: (Appendix 6A) Leheny Corporation manufactures and sells

Q229: All differences between super-variable costing and variable