Multiple Choice

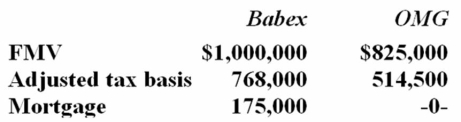

Babex Inc. and OMG Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

A) $175,000 gain recognized; $514,500 basis in Babex property

B) No gain recognized; $689,500 basis in Babex property

C) No gain recognized; $514,500 basis in Babex property

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Mrs. Cooley exchanged 400 shares of stock

Q17: Reiter Inc.exchanged an old forklift for new

Q39: Luce Company exchanged the copyright on a

Q60: IPM Inc. and Zeta Company formed IPeta

Q71: Babex Inc. and OMG Company entered into

Q76: Johnson Inc. and C&K Company entered into

Q84: In March,a flood completely destroyed three delivery

Q93: Tarletto Inc.'s current year income statement includes

Q99: Mrs.Brinkley transferred business property (FMV $340,200; adjusted

Q104: Which of the following statements about like-kind