Multiple Choice

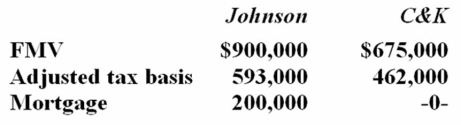

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

A) $25,000 gain recognized; $593,000 basis in C&K property

B) $25,000 gain recognized; $793,000 basis in C&K property

C) $225,000 gain recognized; $593,000 basis in C&K property

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Reiter Inc.exchanged an old forklift for new

Q39: Luce Company exchanged the copyright on a

Q60: IPM Inc. and Zeta Company formed IPeta

Q71: Babex Inc. and OMG Company entered into

Q75: Babex Inc. and OMG Company entered into

Q78: Qualifying property received in a nontaxable exchange

Q84: In March,a flood completely destroyed three delivery

Q93: Tarletto Inc.'s current year income statement includes

Q99: Mrs.Brinkley transferred business property (FMV $340,200; adjusted

Q104: Which of the following statements about like-kind