Multiple Choice

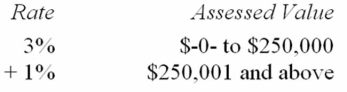

Vervet County levies a real property tax based on the following schedule.  Which of the following statements is false?

Which of the following statements is false?

A) If Mr. Clem owns real property valued at $112,500, his average tax rate is 3%.

B) If Ms. Barker owns real property valued at $455,650, her average tax rate is 2.1%.

C) If Ms. Lumley owns real property valued at $750,000, her marginal tax rate is 1%.

D) None of the above is false.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The sales tax laws of many states

Q7: Jurisdiction F levies a 10% excise tax

Q12: Which of the following taxes is most

Q16: A dynamic forecast of the incremental revenue

Q18: If a tax has a proportionate rate

Q30: Last year, Government G levied a 35%

Q62: Which of the following statements about vertical

Q62: Jurisdiction M imposes an individual income tax

Q63: The U.S. individual income tax has always

Q78: A good tax should result in either