Multiple Choice

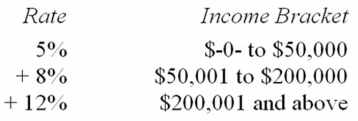

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is true?

Which of the following statements is true?

A) If Mrs. Hall's taxable income is $227,000, her average tax rate is 12%.

B) If Mr. Poe's taxable income is $41,200, his marginal tax rate is 8%.

C) If Ms. Kaye's taxable income is $63,800, her marginal tax rate is 8%.

D) None of the above is true.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A dynamic forecast of the incremental revenue

Q17: The government of Nation C operated at

Q18: If a tax has a proportionate rate

Q31: The state of California plans to amend

Q54: Government L levies a 4% excise tax

Q57: Vervet County levies a real property tax

Q62: Which of the following statements about vertical

Q63: The U.S. individual income tax has always

Q66: Jurisdiction M imposes an individual income tax

Q78: A static forecast of the incremental revenue