Multiple Choice

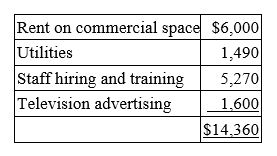

Puloso Company, a calendar year taxpayer, incurred the following start-up expenditures before the opening of its new health and fitness center.  The Puloso Center opened its doors for business on March 21, 2015. How much of the start-up expenditures can Puloso deduct in 2015?

The Puloso Center opened its doors for business on March 21, 2015. How much of the start-up expenditures can Puloso deduct in 2015?

A) -0-

B) $5,000

C) $5,520

D) $14,360

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Broadus., a calendar year taxpayer, purchased a

Q18: Elcox Inc. spent $2.3 million on a

Q49: Marz Inc. made a $75,000 cash expenditure

Q60: A book/tax difference resulting from application of

Q84: Firms engaged in the extraction of natural

Q85: This year, Nigle Inc.'s auditors required the

Q100: Creighton, a calendar year corporation, reported $5,571,000

Q103: Mann Inc., a calendar year taxpayer, incurred

Q105: Deitle Inc. manufactures small appliances. This year,

Q107: Which of the following statements concerning deductible