Multiple Choice

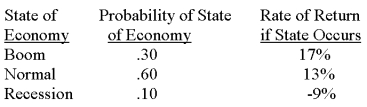

The risk-free rate is 4.35 percent. What is the expected risk premium on this security given the following information?

A) 6.09 percent

B) 6.54 percent

C) 7.65 percent

D) 7.87 percent

E) 8.15 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: You own a stock which is expected

Q11: Terry has a portfolio comprised of two

Q18: Foreign securities are generally considered to be

Q37: Explain the primary goal of portfolio diversification

Q48: You are graphing the investment opportunity set

Q62: Alicia has a portfolio consisting of two

Q75: You combine a set of assets using

Q78: You have a portfolio which is comprised

Q79: You have a portfolio which is comprised

Q81: Tall Stand Timber stock has an expected