Essay

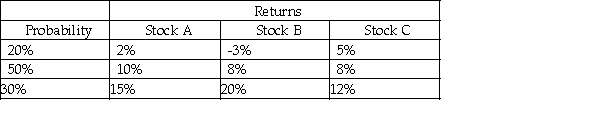

You are considering the three securities listed below.  a.Calculate the expected return for each security.

a.Calculate the expected return for each security.

b.Calculate the standard deviation of returns for each security.

c.Compare Stock A with Stocks B and C.Is Stock A preferred over the others?

Correct Answer:

Verified

a. RA = (.2)(2%)+(.5)(10%)+(.3)(15%)= 9.9...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Beta represents the average movement of a

Q41: According to the CAPM,for each unit of

Q45: You are given the following probability distribution

Q47: An investor currently holds the following portfolio:

Q48: If you hold a portfolio made up

Q68: For a well-diversified investor,an investment with an

Q70: An all-stock portfolio is more risky than

Q85: A well-diversified portfolio includes investments in 50

Q93: The CAPM designates the risk-return tradeoff existing

Q104: Total risk equals systematic risk plus unsystematic