Multiple Choice

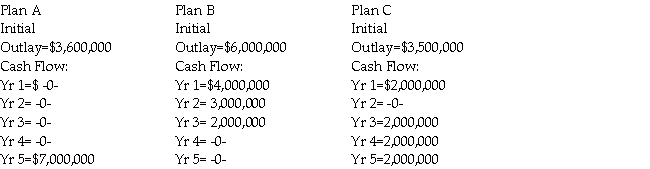

Interstate Appliance Inc.is considering the following 3 mutually exclusive projects.Projected cash flows for these ventures are as follows:  If Interstate Appliance has a 12% cost of capital,what decision should be made regarding the projects above?

If Interstate Appliance has a 12% cost of capital,what decision should be made regarding the projects above?

A) accept plan A

B) accept plan B

C) accept plan C

D) accept Plans A,B and C

Correct Answer:

Verified

Correct Answer:

Verified

Q25: A significant advantage of the payback period

Q40: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2783/.jpg" alt=" The Internal Rate

Q44: Consider a project with the following information:

Q45: If the NPV (Net Present Value)of a

Q49: The profitability index provides an advantage over

Q61: A project would be acceptable if<br>A) the

Q70: An independent project should be accepted if

Q80: NPV is the most theoretically correct capital

Q106: If a firm imposes a capital constraint

Q137: A project's net present value profile shows