Essay

Silver Prices

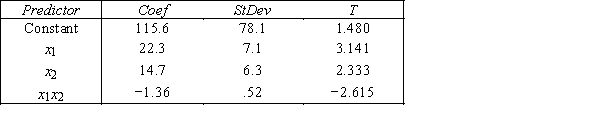

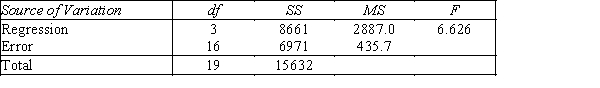

An economist is in the process of developing a model to predict the price of silver.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the first-order model with interaction: y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below. THE REGRESSION EQUATION IS y = 115.6 + 22.3x1 + 14.7x2− 1.36x1x2  S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

-{Silver Prices Narrative} Do these results allow us at the 5% significance level to conclude that the model is useful in predicting the price of silver?

Correct Answer:

Verified

H0: β1 = β2 = β3 = 0,H1: At least one βi is no...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Discuss briefly the procedure that is employed

Q51: In a first-order polynomial model with no

Q52: An indicator variable is also called:<br>A)a response

Q53: Incomes of Physicians<br> An economist is

Q54: The model <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4388/.jpg" alt="The model

Q56: Motorcycle Fatalities<br> A traffic consultant has analyzed

Q57: Hockey Teams<br> An avid hockey fan was

Q58: The stepwise regression procedure begins by computing

Q59: Indicator variables can assume as many values

Q60: When the dependent variable is nominal,a(n)_ regression